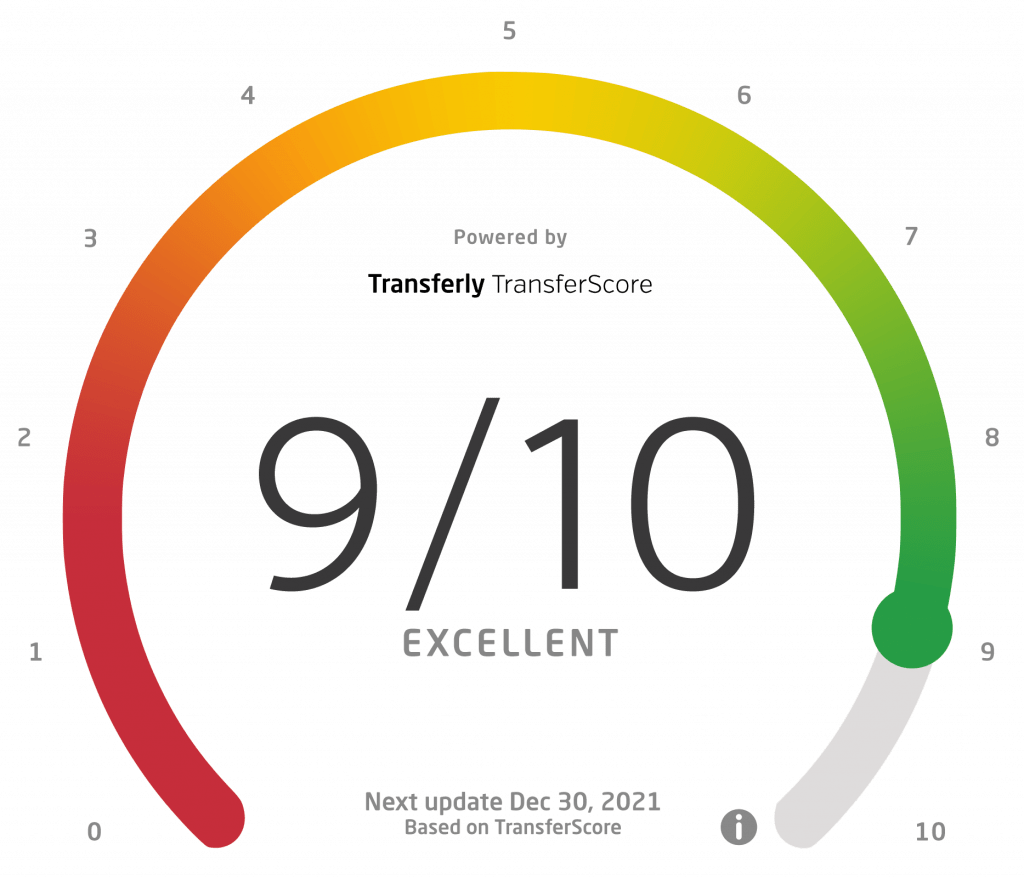

Transferly's Official Review of Azimo

Azimo Rating Breakdown

- A great variety of country combinations, low fees, and competitive exchange rates

- Not yet available for USA citizens

With Azimo, you can send money to over 200 countries. Popular currencies include: GBP, CNY, EUR, USD, AUD, JPY, …

For the complete list of countries and currencies available, see this page: https://azimo.com/en/countries.

Pros

- Affordable Fees - Transactions at Azimo come with affordable fees and competitive exchange rates, especially when compared to what banks and some other money transfer platforms have to offer.

- Many Delivery Options – Azimo has a wide range of supported delivery options, including bank deposits, cash pickups, mobile wallet payments, and airtime top-ups. There are also several payment methods available for funding your transfer.

- Can Receive In Most Countries – Azimo has impressive coverage of more than 200 countries worldwide.

- Multilingual – The platform is available in nine different languages.

Cons

- Sending Countries Limited – While you can send to more than 200 countries, Azimo only allows you to send money from several countries in Europe, Canada, and Australia.

- No Cash Payments – Payment methods do not include cash — you can only fund your transfer with a debit/credit card or a bank transfer

- Confusing Delivery Method Options – Available delivery methods change according to the country combination for the specific transaction. Make sure you check Azimo's website to see which options are available for your desired pair of countries.

Kenneth James

- Last updated: September 29, 2023

- By Kenneth James

The market for money transfer services is quite large and extremely competitive. There are many platforms that struggle to stand out and provide a competitive advantage that attracts new and recurring users. However, there are some tried-and-true platforms that are regarded as an industry staple and are used by millions of users worldwide. In this review, we will present you with one such platform — Azimo.

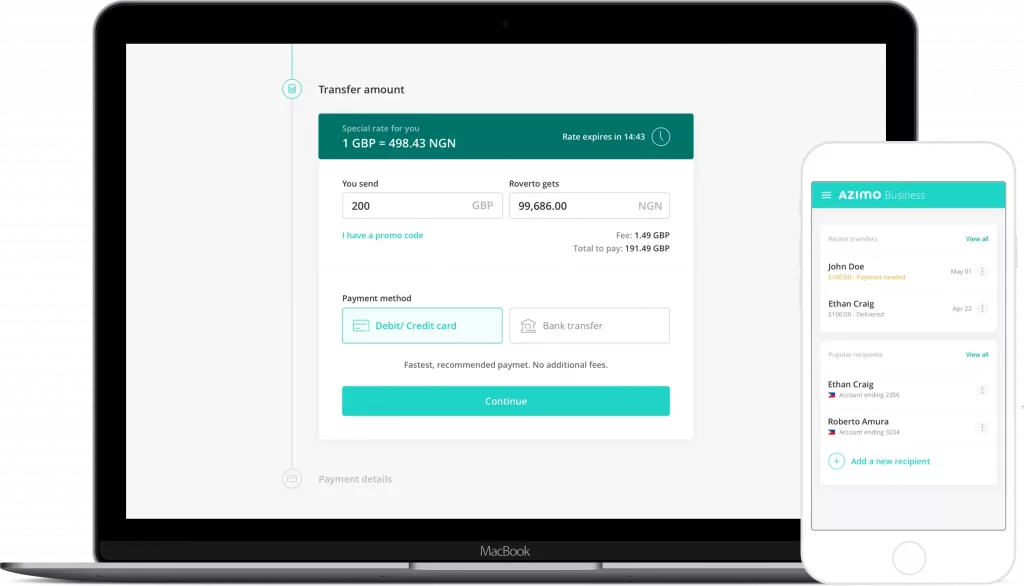

Founded in 2012 in the UK, Azimo’s mission is to provide fast and cheap international money transfers. It allows you to make quick and convenient money transfers from anywhere, anytime, thanks to its handy website and mobile app. As a great alternative to traditional money transfer options, Azimo is often used for sending money abroad. You can fund your transaction with a bank transfer or a debit/credit card, while delivery options include bank deposits, cash pickups, mobile wallet transfers, and even mobile airtime top-ups.

Azimo has impressive coverage around the world — it allows you to send money in more than 80 foreign currencies to over 200 countries and territories. It also has a partner network of over 200,000 physical locations worldwide where people can pick up their money in cash.

The popularity of Azimo comes in large part because of its low fees and competitive exchange rates. Compared to standard bank transfers, Azimo manages to keep costs low by not accepting cash payments and operating entirely online. The platform is widely used by immigrants who want to send money back to their home country without paying a lot in transfer fees. On top of that, it comes translated into 9 different languages, making it convenient for millions of people around the world.

Azimo Fees & Exchange Rates

Depending on the country combination, payment method, and delivery method, Azimo will charge you either a fixed fee or a commission. A standard fixed fee for some of the major country combinations (from the UK to the USA, for example) is £1.99. However, the fee might change, so make sure you check what fees are applicable for your desired country combination.

Generally, Azimo is better suited for sending large amounts of money rather than small ones. Because of the fixed fees, the more money you send, the more affordable the transaction is. We recommend looking for an alternative money transfer service if you plan on using Azimo for frequent transfers of smaller amounts of cash.

One of the best things about Azimo is that, unlike banks, the exchange rate for your transaction is locked the moment you confirm the transfer. As a result, you will know exactly how much money your recipient will get. However, the platform does not operate at mid-market exchange rates — much like most similar money transfer services out there. Azimo applies a markup on their exchange rates as a way for the company to make a profit.

The exchange rate markup at Azimo varies based on the country and currency combinations you have chosen for the transaction. Depending on those factors, the markup can go from 0.05% to 2.50% above the average mid-market rate.

When it comes to payment options for funding your Azimo transfer, you can choose between a bank transfer, debit card, or credit card. Keep in mind that using a credit card might result in some additional charges. If you are not sure what payment option is the best one for your particular transfer, feel free to contact Azimo’s customer service via phone, email, or the website’s support center.

Delivery options at Azimo are plenty but vary depending on the recipient’s country. You can go with a standard bank or mobile wallet transfer. Additionally, you can make use of the airtime top-up service, which can be quite convenient in many cases. Finally, you can choose a cash pickup from one of the 200,000 Azimo partner locations worldwide.

How long does it take for Azimo to send money abroad?

Azimo is a popular and reputable money transfer service that enjoys the confidence of millions of users worldwide. As you might imagine, the platform takes all needed measures to ensure the safety and security of each transaction and all personal information. Azimo is a licensed Authorised Electronic Money Institution that is under the regulation of the Financial Conduct Authority and Her Majesty’s Revenue and Customs in the United Kingdom.

Based in the UK, Azimo operates under the country’s financial laws and regulations, including the Financial Services and Markets Act 2000, the Electronic Money Regulations 2011, and the Payment Services Regulations 2017. Additionally, Azimo also abides by all laws and regulations in the countries you send money to.

With Azimo, user’s accounts are kept separate from the company’s business accounts, making sure all your money is safe in case Azimo faces financial troubles. If for some reason your transaction does not go through, you are entitled to 100% reimbursement — you cannot lose any money while using Azimo. Furthermore, each transaction made through the platform is protected by 256-bit SSL encryption with a 2048-bit signature.

Azimo enjoys immense popularity among its users, especially those residing in the United Kingdom. On the trusted review website Trustpilot, the platform has a rating of 4.6/5, based on more than 52,000 reviews. An overwhelming majority of reviews (78%) rate the services as Excellent, while 14% rate it as Good. Let’s take a look at some of the positive and negative things users have to say about Azimo and its features.

Positive Feedback

- Azimo is regarded as a reputable, dependable, and trustworthy money transfer service

- Transactions are generally described as fast, convenient, and easy to execute

- Transfer speed at Azimo is considered exceptional among users

- Transfer fees at Azimo are low and exchange rates are favorable to users

Negative Feedback

- Some customers report issues with Azimo’s partner locations in certain countries

- Customer service is sometimes slower than expected

- On rare occasions, some transfers take longer to clear than they should

Before being able to make money transfers with Azimo, first you need to create an account on the platform. The process is quite simple and straightforward, and will take you just a few minutes.

- Go to the Azimo website and click the Sign Up button

- Enter your name, email, and basic contact information

- Provide verification documents as needed. Your transfer limits might be significantly smaller unless you verify your identity with the needed documentation.

Once your account is registered and verified, you will be able to make your first money transfer with Azimo. While the process itself is quite simple and straightforward, we recommend you first check out the applicable fees and exchange rates for the particular transaction you want to make. It is quite possible that other money transfer services offer better terms for your needs.

If you are satisfied with Azimo’s fees and rates, here are the specific steps you need to take in order to create a money transfer through the platform.

First, you need to select the country of residence of your recipient, the currency you will send, and the delivery method you want to use for the transaction. Depending on your choice, delivery options might include bank deposit, SWIFT transfer, cash pick-up, and more.

Next, you need to enter the personal information of your recipient. Depending on the delivery method chosen, you might have to enter their full name, address, banking details, email address, and more.

You will then be asked to input the amount of money you want to send and select your payment method of choice. At this point, you will see the fixed fee you will have to pay, the exchange rate for the transaction, and the total amount you will end up paying.

At the bottom of the screen, you will be asked to provide the reason for your transaction. Feel free to input anything you wish. You will also be asked to provide your debit/credit card details at this step.

Review all the details for your transaction and ensure everything is okay. Once you are done, you need to simply hit “Send Money” and the transfer will be executed.

You can keep an eye on the status of your transaction by checking out your Azimo dashboard. Alternatively, you can check your email — Azimo will keep you updated with regular messages regarding the status of your order.

If you want to make international money transfers while on the go, you can use the Azimo mobile app. Available for both iOS and Android, the app offers all functionality and features present in the web version of the platform. On Google Play, the Azimo app has a rating of 4.6/5, based on more than 28,000 reviews. On the Apple Store, it has a rating of 4.5/5 based on around 400 reviews.

The Azimo mobile app is fast, reliable, and convenient, making sending money while on the go a breeze.

Sending money to bank accounts, cash pickup locations, mobile wallets, or mobile phone top-ups

It's easy to view your transaction history

You can check exchange rates and transfer costs

You can use the app to register

No matter what device you have, there's an app for you!

for Azimo customer phone support, you have to first login to their support portal.

you can email Azimo customer support directly at [email protected].

Final Word

Azimo is undoubtedly one of the best money transfer services currently on the market. It offers a great variety of country combinations, low fees, and competitive exchange rates. The transfer speed is exceptional and the platform provides excellent support and customer service. The only real problem Azimo has is that it is still not available for US citizens.

We highly recommend Azimo for your money transfer needs, especially if you reside in the UK. However, if you are a US citizen, you need to find a different money transfer service that supports sending and receiving money from the States.

How Do I Send Money via Azimo?

In order to send money through Azimo, first, you need to create an account on the platform. Once you log in, all transactions are made through a simple, straightforward interface. You can choose from more than 80 currencies and 200 countries and territories to send to. All you need to do is select a delivery method and input the recipient’s personal and banking information.

How Long Does Azimo Take to Transfer Money Abroad?

Transfer speed at Azimo depends on a variety of factors, including the country combination, payment method, and delivery option chosen for the specific transaction. Generally, most international money transfers with Azimo take less than 24 hours to clear. Keep in mind that cash pickup transfers are usually faster than standard bank deposits.

How Do I Track My Azimo Transfer?

Azimo will keep you updated on the status of your transfer with emails and push notifications if you enable them. You can also log into your Azimo account and check the dashboard — the status of all your pending transactions should be visible there as well.

Is Azimo Safe to Use?

Azimo is most definitely a safe and secure money transfer service. After all, it is regulated by the Financial Conduct Authority and Her Majesty’s Revenue and Customs in the UK, while being a fully licensed Authorised Electronic Money Institution. The platform keeps your money and personal information safe with advanced encryption protocols and industry-grade security solutions.

Can I Trust Azimo?

Azimo is a fully licensed Authorised Electronic Money Institution that operates under the regulation of the Financial Conduct Authority and Her Majesty’s Revenue and Customs in the United Kingdom. In other words, yes — you can trust Azimo for your money transfer needs. On top of that, each transaction through the platform is protected by a 256-bit SSL encryption with a 2048-bit signature.

Is Azimo Reliable and Legitimate?

Azimo is trusted by more than a million customers around the world. Over $1.5 billion is safely moved through the platform every year, which is reason enough to consider Azimo a reliable and trustworthy money transfer service.

Is Azimo Better Than Wise?

Azimo and Wise are among the best money transfer platforms currently on the market. Both services offer fast and safe international money transactions with nominal fees and competitive exchange rates. However, we must say that when it comes to fees and exchange rates, Wise is the more affordable option of the two.

Does Azimo Work on Weekends?

While it is possible to send money through Azimo on weekends and holidays, such transfers generally take longer to clear. After all, SWIFT transfers and domestic bank operations get processed only on business days. So, while you can use Azimo on weekends, your recipient will get their money with a slight delay.

Does Azimo Accept PayPal?

PayPal is currently not one of the payment methods supported at Azimo. If you want to fund your Azimo account with PayPal, first you need to withdraw money from PayPal to your bank account and then use it as a payment method. Additionally, you cannot send money to a recipient’s PayPal account either.

How Do I Delete My Azimo Account?

Since Azimo is a regulated service and must abide by lots of rules. As a result, you cannot delete your Azimo account unless you have not made transfers within the last five years. However, it is quite possible to simply deactivate your account instead of deleting it altogether. All you need to do is contact customer support and ask them to do it.

How Do I Contact Azimo Customer Support?

There are several ways in which you can get in touch with Azimo customer service.

• Email them at [email protected]

• Call them directly from Monday to Friday, 9 a.m. to 6 p.m. UK time

• Reach out via the support section on Azimo’s official website

What Will I Need to Pick Up the Funds with Azimo?

In order to pick up money sent through Azimo, you need to present a valid photo ID and the reference number of the transaction itself. Of course, the name on your ID must precisely match what the sender provided when creating the transfer.

Can I Use Azimo in the USA?

Unfortunately, no — Azimo does not yet support money transfers from the USA. The current list of supported countries includes EU/EEA, Switzerland, the UK, Australia, and Canada.

Can Azimo Send Money to Nigeria?

Azimo is one of the several money transfer platforms that is fully authorized by the Central Bank of Nigeria. It is possible to send money to Nigeria through the platform — however, the only supported currency for such transactions is USD. After a decision by the CBN, you can no longer make Azimo transfers to Nigeria using the Nigerian naira as a currency.

Does Azimo Work in Pakistan?

Yes, you can use Azimo to send money to Pakistan. However, keep in mind that it is not possible to send money from Pakistan with the platform. If you want to send money to the country, you can choose between two delivery options — bank deposit or cash pickup at one of the 6,200 agent locations in the country.

Does Azimo Work in Canada?

Yes, Azimo allows you to both send money from and receive money in Canada.

Does Azimo Work in Germany?

Yes, Azimo allows you to both send money from and receive money in Germany.

How Much Can I Send with Azimo?

Transfer limits at Azimo vary depending on the payment method used to fund the transaction. If you are paying via debit/credit card, you can send as much as £12,000 per transaction. However, if you are funding the transaction via a bank transfer, the maximum money you can send is £250,000 per transaction. Keep in mind that some banks might impose their own restrictions — so make sure the recipient checks if they will be able to receive such a sum at once.

How Can I Cancel My Azimo Transaction?

Unfortunately, canceling your Azimo transaction is not as easy as you might imagine. The only way to do it is to contact customer support as soon as possible. Even if you do that, you might not be able to cancel the transfer if it has already been processed through the system.

Does Azimo Work in the USA?

No — people who live in the USA cannot use Azimo to send money abroad. However, USA residents can still receive money sent through the platform.

Methodology

Our team at Transferly is dedicated to finding the best deals for you to send money abroad. We research, analyze, and review money transfer providers big and small to help you find the best providers for your money transfers. With our real-time money transfer comparison engine we find the fastest and cheapest ways for you to send money online. We provide ratings based on several important criteria to our readers.