Transferly's Official Review of Xoom

A comprehensive Xoom review and breakdown of how to send money with Xoom online including their Fees and Exchange Rates, Transfer Speed, Quality of Service, and more.

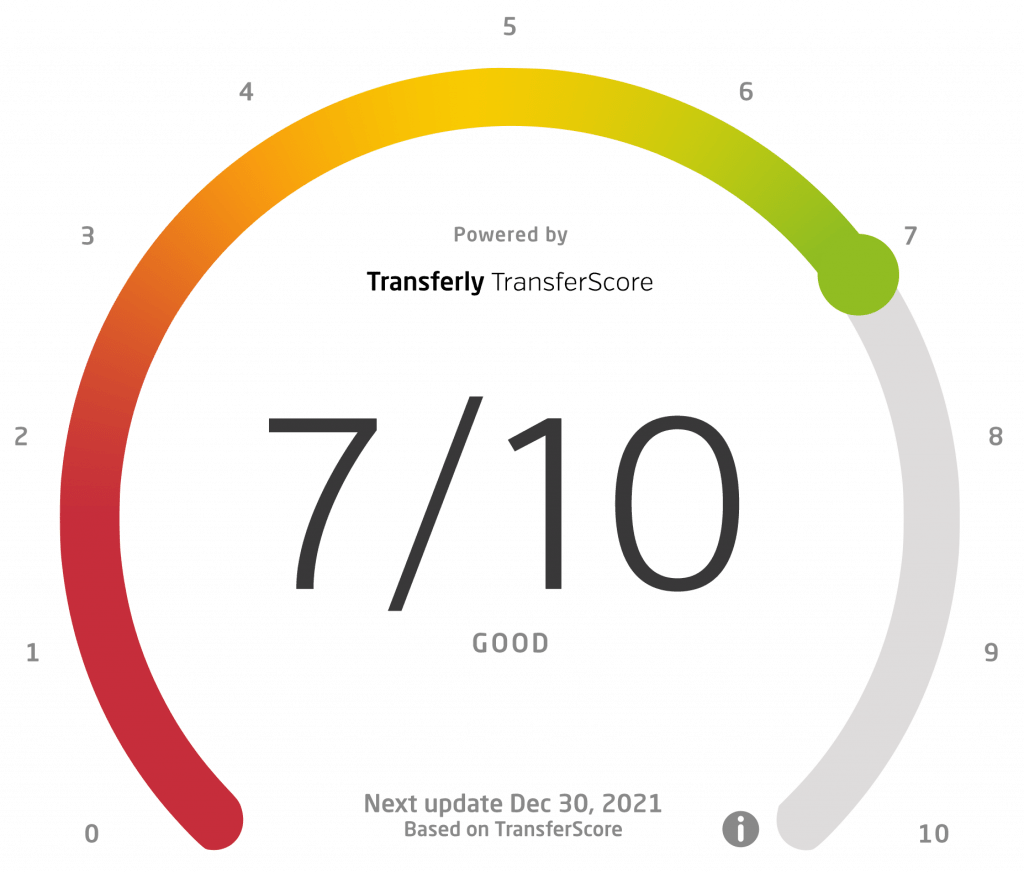

Xoom Rating Breakdown

- Fast money transfers to over 150 countries with hundreds of thousands of agent locations worldwide

- High exchange rates & transfer fees – Compare best rates below

AED, AFN, ALL, AMD, ANG, AOA, ARS, AUD, AWG, AZN, BAM, BBD, BDT, BGN, BHD, BIF, BMD, BND, BOB, BRL, BSD, BTN, BWP, BYN, BZD, CAD, CHF, CLP, CNY, COP, CRC, CZK, DJF, DKK, DOP, DZD, EGP, ERN, ETB, EUR, FJD, GBP, GEL, GHS, GIP, GMD, GNF, GTQ, GYD, HKD, HNL, HRK, HTG, HUF, IDR, ILS, INR, IQD, IRR, ISK, JMD, JOD, JPY, KES, KGS, KHR, KMF, KRW, KWD, KYD, KZT, LAK, LBP, LKR, LRD, LSL, LYD, MAD, MDL, MGA, MKD, MNT, MOP, MRO, MUR, MVR, MWK, MXN, MYR, MZN, NAD, NGN, NIO, NOK, NPR, NZD, OMR, PAB, PEN, PGK, PHP, PKR, PLN, PYG, RON, RSD, RUB, RWF, SAR, SBD, SCR, SDG, SEK, SGD, SLL, SRD, SVC, SZL, THB, TJS, TND, TOP, TRY, TTD, TWD, TZS, UAH, UGX, USD, UYU, UZS, VEF, VND, VUV, WST, XAF, XCD, XOF, XPF, YER, ZAR, ZMW

Pros

- You can track your transfer. Xoom makes it easy to track money transfers by making sure the customer receives a text message once the money has finally arrived. On top of that, the service notifies both parties about the progress, and you can even log in whenever you want to track the transfer through your accounts. Another way to get more information about the money transfers is to contact customer service. A live representative can give an update on the spot.

- There’s unlimited support. Customer service at Xoom is available 24/7 via phone or email.

- You can get a refund if something’s amiss. In case something happens and the recipient does not receive their money in the end, Xoom will refund the funds in full.

Cons

- No chat options for customer service. Yes, there is 24/7 support, but that doesn’t cover live chat. You can either call and wait to get through to a representative or send an email.

- Tedious verification process. If you want to use Xoom to send larger amounts of money, you have to verify your identity and bank account. To do that, you have to send the company a valid government-issued ID — your passport or license, for instance. Xoom also requires a recent bank statement before it allows you to proceed with the transaction.

- It might get a bit expensive. Since Xoom tops the mid-market rate with its own markup and has some additional fees in place, it may not be the most affordable option for all users.

Kenneth James

- Last updated: November 7, 2023

- By Kenneth James

We found Xoom to be quite easy to navigate, which is probably why it is so appealing to users. People who use PayPal will find themselves in familiar waters, since both services are extremely similar.

One of the biggest benefits of Xoom is its coverage — it allows users to send money to more than 150 countries worldwide. On top of that, you can easily send money with Xoom on the go through the convenient mobile app. Another feature that makes Xoom stand out is the excellent transfer speed.

As far as user experience goes, most users say that they’re satisfied, so we do believe that Xoom is a rather good money-transfer service. It has gained the trust of many customers so far, and its Trustpilot reviews confirm this. Out of 21,634 reviews (December 2020), it scores a solid 4.4, with 87% of clients reviewing it as Excellent. The Xoom app also ranks favorably:

- App Store (4.8, 701.2k ratings in December 2020)

- Google Play Store (4.8, 97,385 ratings in December 2020).

One of the downsides of the service, according to customer reviews, is that it is somewhat tricky to use. On top of that, the exchange rates are less favorable than what you would find with other similar services. In the following paragraphs, we will take an in-depth look at everything Xoom has to offer.

Xoom is a money transfer service that is considered one of the best ones on the market. This PayPal-owned company allows users to send money across the globe to 130+ countries from all over the world. The coverage includes the USA, Canada, Europe and the UK.

Xoom operates much like any other money-transfer service out there, but it might be even simpler to use if you have a PayPal account. In general, you can pay for a Xoom transfer with a credit or debit card, as well as with a bank account. But since Xoom is a part of PayPal, its service covers PayPal accounts too. This means you can use any linked credit or debit cards and bank accounts to pay for the transfers, as well as your PayPal balance.

As far as delivery options go, the recipients have plenty of choice. It all depends on where exactly you are sending to, as certain countries may offer limited delivery options. Payment methods at Xoom include cash, bank account, airtime top-up, and home address deliveries.

One of the best parts about using Xoom money transfer is how inclusive the service is. For example, both the app and the website are available in a number of languages:

- English

- Spanish

- Portuguese

- German

- French

- Russian

- Italian

- Dutch

- Polish

- Hungarian

- Romanian

- Korean

- Vietnamese

- Chinese

Xoom allows users to closely monitor everything related to their transactions. For instance, it allows for email notifications or text updates to keep everyone informed about the latest developments.

Unlike most other money transfer services, Xoom can be used to pay bills in some countries. The service covers:

- Mexico

- Guatemala

- Nicaragua

- Costa Rica

- El Salvador

- Honduras

- The Dominican Republic

- Jamaica

Xoom’s Exchange Rates and Fees

The fees for sending money through Xoom vary greatly due to three important factors — the country combination, the payment method, and the delivery option. We found that the average fee falls somewhere between $0 and $5.

The total cost also depends on the exchange rate. Xoom money transfers have certain markups in place, so expect the rate to be above the mid-market one. On top of that, note that there’s also a difference between sending money at agent locations and online. If you can send money with Xoom online, the Xoom money transfer rate will largely depend on:

- How much money you are sending. Naturally, sending $50 and $500 won’t cost you the same.

- The payment method you’re using. Bank transfers are usually the cheapest options across most money-transfer providers, including Xoom. On the other hand, credit card payments come with relatively high fees, including additional cash advance fees.

- Where the recipient lives, as the fees vary by country.

- How the recipient wants the money to be delivered. The fees are (unsurprisingly) higher when sending cash. If you want to cut your costs, you should to make sure the recipient receives the money deposited into their bank account.

Example: Sending Money to Mexico and India

To illustrate, there’s a huge difference in fees when sending money to a country like Mexico and a country like India. If you decide to send $1,000, for example, and use your PayPal balance or bank account to pay for the transfer, the fee will be $0. In comparison, using a credit or debit card would incur a $3.99 fee to send money to Mexico with Xoom and a $30.49 fee to send money to India with Xoom. This data stands as of December 1, 2020.

As you can see, you may be able to get away with paying absolutely no Xoom transfer fees in some cases, usually when sending more money and paying with your bank account. Xoom has a convenient calculator you can use to see the fees for different country combinations and payment methods.

How good the Xoom exchange rate will be the day you decide to send a transfer will largely depend on how much money you are sending. As of December 1, 2020, the rates are as follows:

| Amount | Mid-Market Rate | Xoom Rate | Markup* |

|---|---|---|---|

| $10 – $50 | 73.6505 | 71.9169 | 2.35% |

| $51 – $1,989 | 73.6505 | 72.6492 | 1.36% |

| $1,990 – $1,999 | 73.6505 | varies | varies |

| $2,000 – $9,970 | 73.6505 | 73.0154 | 0.86% |

| $9,971 – $9,999 | 73.6505 | varies | varies |

| $10,000+ | 73.6505 | 73.2351 | 0.56% |

*The formula for calculating the markup is mid-market rate – Xoom rate = X. To get the markup, you then have to divide X with the mid-market rate and multiply by 100.

As you can tell, the more money you want to send, the lower the markup goes, so it pays off more to send larger amounts in as few transactions as possible. However, it all depends on how you’re paying in the end, as debit and credit cards incur higher fees. As of December 1, 2020, sending $10,000 to India can cost nothing (as far as transaction fees go) if you opt to pay with your PayPal balance or bank account. On the other hand, it could cost you $301.49 if you pay with a credit or debit card.

In the case of transfers made from the USA, there are three payment methods to choose from:

- PayPal balance

- Bank account transfer

- Credit or debit card

Keep in mind that each method incurs different fees that largely depend on the recipient’s country. In general, though, it has been shown that paying with your PayPal balance or bank account costs the least.

When it comes to money-transfer services, most of us, if not all, are interested in making the process as effortless and speedy as possible. But you have to remember that providers take multiple factors into account to enable a faster service.

The speed of your Xoom transfers will depend on the countries taking part in the transfer, their respective currencies, the payment method and delivery option you choose, the amount you’re sending, and security checks. The fastest and cheapest options are as follows:

- The cheapest option is to use a bank account. If you opt to use your bank account to send the transfer, you’ll definitely be able to save more money than by using a credit or debit card. However, this is also the slowest option, as it may take up to four business days for the money to arrive, or more if the delivery is made to a bank account too.

- The fastest option is to use your PayPal balance or credit or debit card. In some cases, sending the money with your balance may cost $0 or incur some lower fees. Using credit or debit cards will certainly result in a higher cost. The processing is almost instant, though, despite the fact you may even have to pay an additional cash advance fee. Some countries, however, may delay the transfer a bit even if you opt to use a card.

Is There a Way to Speed Up the Transfers?

Of course, there are some things you may be able to do to make sure the money gets to the recipient faster.

First, you should ensure you have all the information before trying to send the transfer. This includes the personal information of both parties, as well as their bank account details. Xoom or the recipient’s bank will need the basics, like names, addresses, and contact information.

Once you’re sure you have all the required information, you should to consider the banks’ operating hours, as well as the operating hours of home delivery services and cash pickup agents. Furthermore, you should be available to verify your bank account quickly so that the processing doesn’t get delayed.

Once you have everything settled and the transfer is on its way, you can track the transaction through your account. Alternatively, Xoom will update you with text messages or emails.

There are three Xoom money transfer limits US residents should be mindful of when using Xoom to send money transfers:

- Daily limit of $2,999

- Monthly limit of $6,000

- Six-month limit of $9,999.

However, these limits aren’t set in stone, as you can raise them by providing additional personal information and documents. You may be able to increase them with your:

- ID (driver’s license, passport, and similar documents)

- Bank statement

- Proof of income (payslip)

- Green Card

Xoom has implemented strict security measures that make sure no scams or fake accounts make their way on the platform. For example, customer services will ask users a variety of questions to ensure the account is authentic. They may inquire about the reason for the money transfer, how well you know the beneficiary, and whether you are sending the money instead of someone else. They may also ask what you do for a living.

How Much Money Can I Send Through Xoom?

One of the features that make Xoom stand out among other money-transfer companies is that it categorizes accounts into separate levels. This categorization is based on the level of verification needed for certain accounts.

US residents are categorized in one of the following three levels:

| Level | I | II | III |

|---|---|---|---|

| 24-hour limit | $2,999 | $10,000 | $50,000 |

| 30-day limit | $6,000 | $20,000 | $60,000 |

| 180-day limit | $9,999 | $30,000 | $100,000 |

| Information and documents necessary for verification | Phone number and email address | Passport or your SSN (Social Security Number) | ID (passport, driver’s license) or Green Card and proof of address (a utility bill, for instance, payslip, or bank statement). * Xoom may request additional information. |

Xoom is owned by PayPal, an online money transfer service that is renowned for its reliability and security. Given this relation, it is no surprise that Xoom also has exemplary safety policies. To ensure the transfers are as secure as possible, though, Xoom implements additional measures and precautions:

Xoom is licensed and regulated by the same entities as PayPal.

The website uses 128-bit data security encryption.

In case something happens to the money, Xoom offers refunds. It guarantees that the transfer will be sent and received as promised. However, if that doesn’t happen, the company is ready to reimburse it in full.

Is Xoom the Same as PayPal?

Since it is in PayPal’s ownership, Xoom is operated by the company and is its proprietary service. Thus, PayPal users are free to integrate their accounts into Xoom if they need to send money globally. However, the beneficiaries don’t need a PayPal account to get the money.

You usually turn to Trustpilot to check how a certain money-transfer provider is doing, so Xoom was no different. As of December 2020, the company scores 4.4/5 and has more than 21,000 reviews there, and the majority of them are Excellent (87%). Still, there are Bad reviews as well, and they amount to 6%.

It seems that there has also been an influx of bad reviews recently, both Invited and Organic ones. Fortunately, the Xoom customer support team pays attention to those and does its best to resolve each issue.

In general, Xoom’s service has both good and bad sides:

- An easy-to-use service that provides a smooth user experience

- Speedy transactions

- Superb customer service

- The exchange rates aren’t so great due to the markup, and the fees can get pretty steep.

- The verification process was a bit tedious for some customers, as they had to keep sending in new documents. However, this is not unexpected, as all those security checks are necessary for legal and compliance reasons.

- There have been abrupt transfer cancellations (a few days after the initiation) that the customers were confused about as Xoom didn’t provide any explanations beforehand.

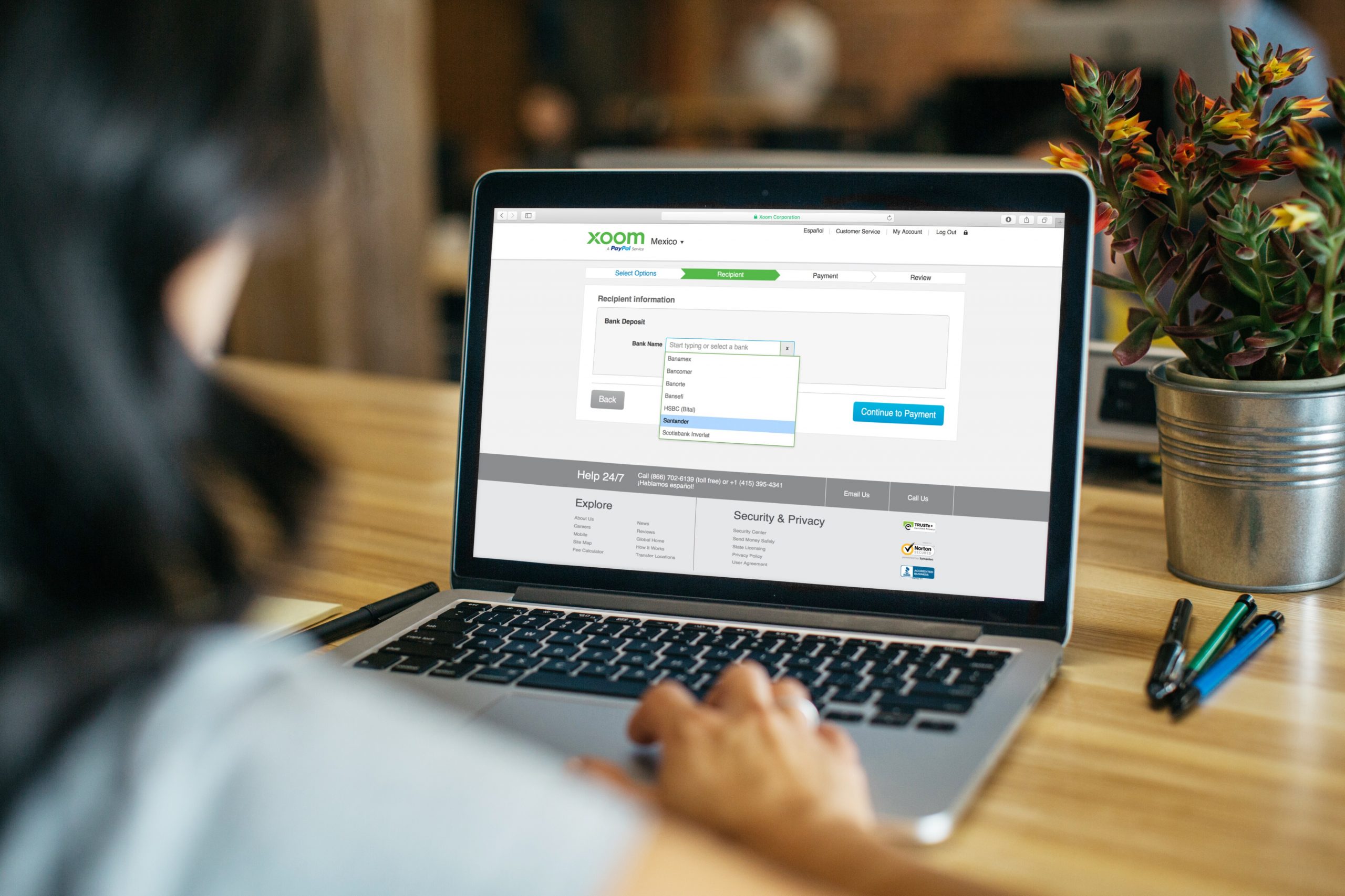

Creating an account and sending money with Xoom is a relatively simple and straightforward process. Let’s take a look at what a user has to go through to use this money-transfer service.

Before initiating a transfer, you have to register for an account. Fortunately, it’s completely free and only requires a few bits of your personal contact information. Xoom won’t need your SSN upon registering. However, if your transfers are a bit larger, it will prompt you to provide a government-issued ID (passport or license, for example) and proof of address (a recent bank statement).

Xoom needs to know who the recipient is and where they live. The services aren’t the same for all countries, and your fees depend on this anyway.

You have to confirm how much money you want to send with the transfer. Furthermore, you need to choose a payment method at this point.

You can use your PayPal balance to pay for the transfer, as well as a credit or debit card or a local bank transfer.

Once the transaction has been initiated, Xoom will proceed with the currency conversion and deliver the money via one of the chosen delivery methods.

The information Xoom requires from you to send a transfer includes:

- Your personal contact information, i.e., address and phone number

- The beneficiary’s personal contact information (name, address, bank and bank account number)

- The amount and the currency you’re sending the money in

- A valid payment method (you can use a bank account, credit or debit card, or your PayPal balance).

To get a decent comparison, you need to select the countries taking part in the transfer and the amount you want to send. Once you click Calculate, you’ll see how much a Xoom transfer would set you back.

If you want to send money to Mexico, you can use Xoom and initiate the transfer at over 37,000 agent locations. Some of them can be found in Walmart (INSERT LINK) and Farmacias Guadalajara, and you can also opt for Elektra, Soriana, and OXXO locations. Alternatively, you can do direct bank transfers. This option covers most bigger banks, like Banca Azteca, Banorte, BBVA Bancomer, and BanCoppel.

Mexico is also one of the countries that let you pay for your utility bills with Xoom. This service covers eight companies in total, including Telnor, dish, and gasNatural. Additionally, you can opt for airtime top-ups, which cover four carriers: Movistar, Unefon, Telcel, and AT&T.

Xoom’s coverage of Guatemala is also admirable, as it includes a great range of banks and institutions, like Banco Industrial, Banco G&T Continental, and Banrural. There is also a solid number of cash pickup locations to choose from — over 9,500. Plus, you can even pay bills with Xoom in this country (Tigo, Tigostar, EEGSA, Energuate, and Claro), as well as reload mobile phones (Claro, Tigo, Movistar).

Xoom covers almost all Colombian cities, including Cartagena, Bogota, and Medellin. Depending on your preferences, you can opt to send cash or ensure the transfer gets delivered directly to a bank account (even your family’s bank accounts!). For cash pickups, you can pick from over 2,500 locations.

Naturally, the service covers major banks like Bancolombia, as well as partner networks like Exito. You can also opt for phone reloads. The service covers five carriers: Avantel, Movistar, Claro, Tigo, and Virgin Mobile.

Vietnam boasts 1,700 cash pickup locations but covers quick bank transfers as well. Its network of banks includes the likes of Sacombank and Vietcombank. Furthermore, it allows for door-to-door deliveries as well, which usually happen on the same day (major cities) or take about two days.

Mobile phone reloads are also available. The service covers four mobile carriers (Viettel, Vietnamobile, Mobifone, and Vinaphone). Paying bills with Xoom isn’t possible in Vietnam anymore.

Finally, we have the Philippines, which boasts more than 10,000 cash pickup locations. Some of these are available 24/7.

The delivery times to other bank accounts will vary, but Xoom offers instant deliveries to accounts in banks like PNB, Metrobank, and BDO. On top of that, the fees are waived if you’re sending more than $200 from one bank account to another.

Cash deliveries can also be arranged, and the delivery times are quite convenient. In Manila, the recipient can get their money in as few as six hours. In most other provinces, the delivery may take one to two days.

Of course, it’s possible to make phone reloads as well to numbers at Globe, Smart, and SmartBro. Sadly, it doesn’t seem like it’s possible to pay for bills through Xoom in the Philippines anymore.

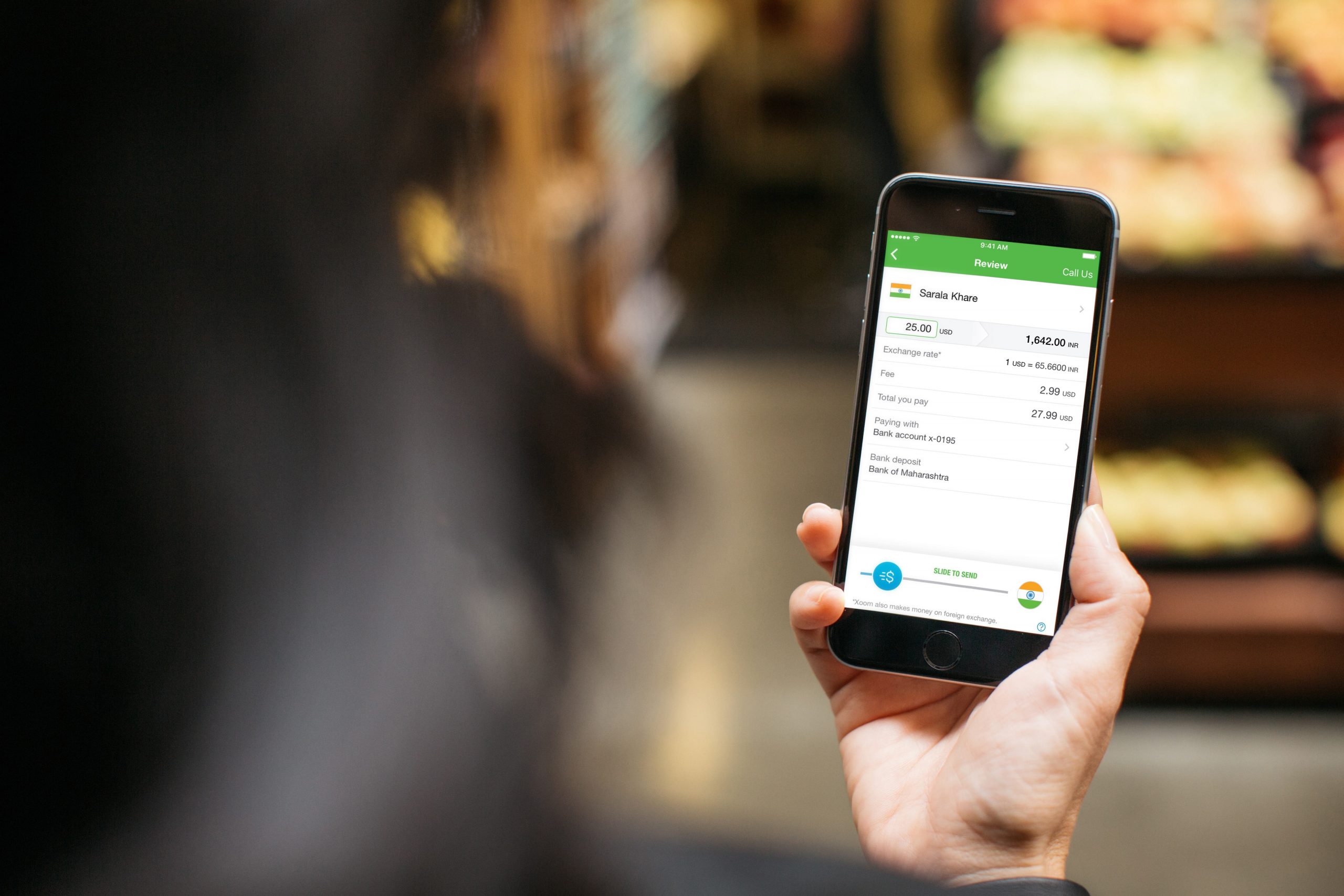

The Xoom app is praised among the many Xoom users on both the App Store and Google Play, scoring high marks across the board. One of the best features of the app is that it lets you stay on track with your transactions on the go, keeping you updated with notifications and texts.

The Xoom mobile app is available in multiple languages, including:

- English

- German

- French

- Italian

- Spanish

- Dutch

- Hungarian

- Polish

- Romanian

- Portuguese

- Russian

- Simplified Chinese

- Vietnamese

- Korean

You can go through your existing contacts and initiate a transfer in mere seconds.

The app itself has a calculator that helps you with establishing the cost of each transfer and comparing the rates to make sure you receive the best deal every time.

The Xoom app lets you track your Xoom transactions, as you can easily access them through the app and check their status.

Other than that, it’s possible to share order information with your contacts. Better still, the app allows you to check the exchange rates wherever you are so that you’re always a step away from the best money transfer

Final Word

Is Xoom worth it even though it may cost more in fees and exchange rates? We believe it is, as the company has shown that it’s reliable and able to offer a good, and most importantly, quick service. Still, we do recommend doing some research before sending in a transfer and comparing the costs of Xoom with other providers. After all, the best deal is attainable with enough knowledge — and we definitely don’t want to rob ourselves of it.

Frequently Asked Questions (FAQs)

In the case of most countries, you can arrange direct bank account transfers with Xoom. Alternatively, some destinations offer cash pickups as well.

Keep in mind that in some cases, EUR or GBP bank accounts may not be available to use with Xoom even if we’ve linked them to your PayPal account. In general, PayPal users can link their Xoom with their PayPal account. All you have to do is log in to your Xoom account and click the “Continue with PayPal” button. However, it’s not necessary to have a PayPal account to receive a Xoom payment.

Once you are ready to pay for the transactions, you will get to choose from a number of payment methods unique to PayPal. You can opt to pay for the Xoom transfer with your PayPal balance, bank account, debit, or credit card. These should be linked to your PayPal account. The balance payment option is only available if you have enough funds to pay the whole transaction. It must also be in the same currency as the money you’re sending.

You can also link your PayPal account with other payment methods that you can use with Xoom too. All you have to do is visit PayPal, log in, and navigate to the “Wallet” page. Once there, you can add a new bank account or card.

Right now, when using Xoom, you cannot send the money to someone’s PayPal balance.

No, you cannot use Xoom for business purposes. It’s only used for remittance transfers between individuals.

There are a few ways users can track transfers on Xoom, the most convenient of all being email notifications and text updates. You can also call Xoom support and ask about the status of a transfer or check the status on the platform. Usually, the transfers are made within mere minutes. Sometimes, though, it takes up to four business days for a transaction to go through.

Xoom allows users to schedule transfers and set them up automatically for the future. It also lets you set up recurring transactions.

Yes, Xoom allows users to cancel their transfers. All you have to do is log in to your account and navigate to the Track my transaction page. Alternatively, you can contact customer service via phone. The following are the numbers you can use in different countries. More information can be found here.

- United States and Canada: (877) 815-1531 (toll free); +1 (415) 395-4225

- United Kingdom: +44 207 949 4440

- Germany: +49 69 380 798 14

- France: +33 1 73 43 10 47

- Spain: +34 91 835 1055

- Italy: +39 0223312012

- Netherlands: +31 70 700 6463

In case you don’t reside in these countries, you can call any number above. International charges do apply.

If the recipient doesn’t pick up the transfer or the transfer hasn’t been deposited, delivered, or paid for, it will be canceled. The refunds are usually initiated within three business days. Keep in mind that the processing takes about 1–4 business days.

In case you need some help regarding Xoom, its services, and more, you can email the customer service. Email support is available in multiple languages:

- English

- Arabic

- French

- Italian

- Spanish

- German

- Vietnamese

- Chinese

Due to the poor exchange rates and markups, Xoom isn’t so cheap when it comes to sending money abroad. To get the best deal, we suggest using Transferly’s money transfer comparison tool to check different providers.

Since Xoom is a part of PayPal, it’s only natural that it’s just as secure and confidential as its parent company. The regulations PayPal holds are impressive and issued by a range of US agencies and state governments. This all plays well into the idea that Xoom is a safe and secure money-transfer service.

Another thing to keep in mind is Xoom’s Trustpilot reviews and the fact that the company issues refunds whenever necessary. In case the transfer isn’t completed, you can get the money back in full.

As far as its credibility and security go, Xoom certainly holds up. Still, it may not be the most affordable option for sending money abroad. You can use Transferly’s comparison engine to verify that.

Just like with most providers, you cannot use money-transfer services for free. However, there might be a way to lower the Xoom costs a bit:

- You can use Transferly’s comparison engine to ensure you’re always getting the best deal possible. Instead of calculating it all yourself, this engine lets you see immediately how much you can save on exchange rates and fees.

- Xoom also has a price estimator on its website that shows the exchange rates and fees. You ought to recheck the real exchange rates, though, as Xoom tops up its rates with a markup.

- Since credit cards may incur additional fees, like the cash advance ones, you ought to steer clear from using them whenever possible. Both the card issuer and Xoom may charge extra in this case.

- Opt for another provider that offers lower fees and convenient exchange rates. Transferly’s comparison tool can help with that, of course.

We wouldn’t say that Xoom is a wire transfer, as the service is a part of PayPal and lets you send money instantly online. You can opt to have the money delivered not only to a bank account but right at the recipient’s doorstep and at cash pickup locations. The range of options, however, varies by country.

In theory, we’d say that Xoom is a good option. However, in practice, this largely depends on the amount you’re sending and the country you’re making the transfer to. It’s definitely convenient since you’re able to send money without making any bank visits. You don’t even have to go to an agent location — you can use the app. To find out if it’s the most affordable option right now, though, we opt to use Transferly’s comparison engine.

Yes, Xoom may ask for your SSN since that’s an identification method unique to each individual. The SSN lets a financial institution (like a bank) use it as a signature for money transfers and other financial activities. Thus, it’s also a tracking tool.

What are the Xoom fees for sending money? Well, it all depends on:

- The currencies and countries taking part in the transfer

- The transfer amount

- Our preferred payment method

- How the recipient wants the money to be delivered

Generally speaking, Xoom uses the fees to make a profit (not for every payment method), and it also gets a piece of that exchange rate cake by adding a markup to it. To illustrate, if you were to send $1,000 from the US to the UK with Xoom, the fee would be $0 if you pay from your PayPal balance or bank account. A credit or debit card fee, however, would be $30.49.

This doesn’t come cheap, so it’s best to use Transferly’s comparison engine to check how much it would all cost.

Transferly shows how much money the recipient will get, as well as how high or low the exchange rate and transaction fees are (and thus your total cost). Its comparison tool can help you discover how much you’d have to pay in just a few clicks.

Apart from allowing for home deliveries and cash pickups, Xoom also lets you send international payments to the recipient’s bank account. The service covers more than a hundred countries.

Yes, Xoom covers Colombia and lets you make money transfers to it without much hassle. The fees may add up quickly, so we recommend checking out Transferly for a comparison of a few money-transfer companies that allow for transfers to Colombia.

Mexico is one of the main countries Xoom covers. However, we cannot vouch for the fees and suggest checking a couple of providers through Transferly’s comparison engine.

Yes, Xoom covers India as well, but the transactions incur staggering fees. For a better deal, we suggest checking Transferly and comparing a few providers.

The recipient can use a number of methods to receive the transfer:

- Direct bank account deposit

- Cash pickup (there are thousands of agent locations available)

- Door-to-door delivery

- Bill pay

- Mobile top-up.

Unfortunately, not all options are available in all countries or even currencies. Furthermore, there might be some additional fees, like the transfer fee a bank may charge the recipient for. Because of that, remember to agree on a delivery method before sending the money.

If you’re looking to make a transfer directly to a bank account, you will need to provide the following details:

- Personal information of the recipient (name, address, country)

- Banking details (account number, routing number, or sort code). Sometimes, you may need to input the SWIFT code, IBAN, or the bank identifier too.

Bank transfers may incur an additional fee, which is charged by the receiving bank and has nothing to do with Xoom or its services.

Yes, in case you lose your password, you can reset it in just a few easy steps:

- Go to the recovery page on the official website and enter your email. Check if it’s the same one you used to register for an account.

- You’ll get an email from Xoom that has a “Create a new password” option somewhere in the body. When you click it, it will redirect you to Xoom’s website.

- Once on the website, you’ll have to verify some data in order to reset your password. After that, you’ll get to create a new one. Make sure it’s hard to break and unique to your Xoom account, i.e., you’re not using it for something else too.

- Log in to the account to check if the password works.

Xoom does not allow users to delete their account directly from the website or mobile app. The only known method is to contact customer service via email (through the website) or phone (the full list of numbers is right here). Since it has widespread coverage, Xoom has different phone numbers for certain countries:

- United States and Canada: (877) 815-1531 (toll free); +1 (415) 395-4225

- United Kingdom: +44 207 949 4440

- Germany: +49 69 380 798 14

- France: +33 1 73 43 10 47

- Spain: +34 91 835 1055

- Italy: +39 0223312012

- Netherlands: +31 70 700 6463

These numbers work for all other countries too. Keep in mind that the international charges apply.

Email customer support is also available in multiple languages:

- English

- Arabic

- French

- Italian

- Spanish

- German

- Vietnamese

- Chinese

Xoom offers gifts and other incentives if you decide to refer family members, friends, and others and help them sign up and start making transfers. Some of the rewards include a Mastercard prepaid debit card you can use to make some purchases. You may also get Amazon eGift cards.

Referring a friend is also really easy. All you have to do is log in to your account and go to the “Refer a Friend” page. The invitations can be sent via email, Whatsapp, or through Facebook (and Facebook Messenger). In order to sign up, the referrals should use the link you sent them to register. In return, you can receive certain awards as soon as they start making transfers.

Depending on where they live and how much they spend, the rewards are as follows:

- USA: the referrals have to spend 50+ USD for you to receive 10 USD

- Canada: the referrals have to spend 50+ CAD for you to receive 10 CAD

- United Kingdom: the referrals have to spend 50+ GBP for you to receive 10 GBP

- Europe: the referrals have to spend 50+ EUR for you to receive 10 EUR. Some countries allow for residents to get two cards with a similar total value.

- Other Countries: the referrals have to spend 50+ USD/CAD for you to receive 10 USD. The payment sources have to be US – or Canada-based.

Xoom makes sure that its rates are constantly being updated, so the calculator available on the website is accurate and able to show how much a transfer would cost and at which exchange rate in a matter of seconds.

Transferly believes that Wise might be the better money-transfer service of the two. Wise is a better option if you want to send more than $50,000, and it may be cheaper even if you’re looking into sending smaller amounts. The savings may not seem like much at the time being, but they do add up quickly, especially if you have lots of small payments to process or need to make a couple of larger ones.

However, Xoom offers cash payouts, which may be more convenient for some users.

Xoom is generally more economical than Western Union. This is mostly due to its fees, which are lower, and exchange rates, which are more favorable even with the markups.

Xoom offers lower fees and better terms for sending money from a debit/credit card to a bank account. However, PayPal remains one of the cheapest options for transferring money between bank accounts. Check the fees and exchange on both platforms to see which one is better for your specific needs.

Transfer speed at Xoom depends on a variety of factors, including the country and currency combination, payment and delivery methods, and transfer amount. Paying with a debit/credit card is usually the fastest option, but it comes with the highest fees. Funding your transfer via bank account takes the longest, but you will not pay fees.

Transfer limits at Xoom vary depending on the country combination for the transaction. If you transfer to India, the maximum amount you can send per transaction is $50,000. This amount is available only if you have provided all needed verification at the platform. Xoom also imposes a monthly limit of $60,000 for fully verified accounts.

Fees at Xoom vary greatly depending on the country combination, payment method, and delivery option selected for the transaction. For the Philippines, the average fee will be from $0 to $5. Keep in mind that Xoom does not operate at mid-market rates and puts a margin on its currency exchange.

Methodology

Our team at Transferly is dedicated to finding the best deals for you to send money abroad. We research, analyze, and review money transfer providers big and small to help you find the best providers for your money transfers. With our real-time money transfer comparison engine we find the fastest and cheapest ways for you to send money online. We provide ratings based on several important criteria to our readers.